Articles

Power, prestige and the playbook: How sovereign wealth funds are rewriting the global sports order

The professionalisation of sport has taken many forms – from the structural logic of multi-club ownership to the financial discipline of private equity. But perhaps the most powerful force reshaping…

The professionalisation of sport has taken many forms – from the structural logic of multi-club ownership to the financial discipline of private equity. But perhaps the most powerful force reshaping the global sporting landscape isn’t a fund or a holding group. It’s a nation.

Sovereign wealth funds (SWFs) – state-backed investment vehicles – are no longer just allocating capital to sport. Alongside MCO consolidation and PE precision, SWFs represent a third major force: scale, permanence and geopolitical strategy. This isn’t financial engineering, we’re talking diplomacy with a scoreboard.

The new power players in sport

Sovereign investment in sport is about more than commercial returns. It’s about national influence, cultural positioning and soft power projection. These funds are reshaping global perception through sport, driven by long-term strategic goals:

- Diversify economies beyond oil

- Build soft power and international relevance

- Stimulate youth engagement, tourism and employment

- Expand into new industries such as: media, tech, entertainment

In this deep-dive, we look through the lens of sport as a statecraft – and the budgets are nearly unlimited.

Who’s playing and what they’re buying

Public Investment Fund (PIF) – Saudi Arabia

- Owns Newcastle United FC

- Created LIV Golf in direct competition with the historical PGA Tour (CNBC)

- Hosting WWE, Formula 1 and heavyweight boxing events

- Investing in esports and women’s football as part of Vision 2030

Qatar Sports Investments (QSI)

- Owners of Paris Saint-Germain (PSG)

- Delivered the 2022 FIFA World Cup

- Active in tennis (ATP, WTA), handball and cycling sponsorships

- Seeking further European club stakes, and active in content/media strategy to extend Qatar’s cultural reach

Abu Dhabi (ADQ, Mubadala, and Abu Dhabi United Group)

- Major backers of City Football Group, with clubs in 13 countries

- Strong presence in F1 via Yas Marina Circuit and team sponsorships

- Ties to UFC, regional basketball and global sports innovation zones

- Positioning Abu Dhabi as a centre of sporting innovation and event excellence

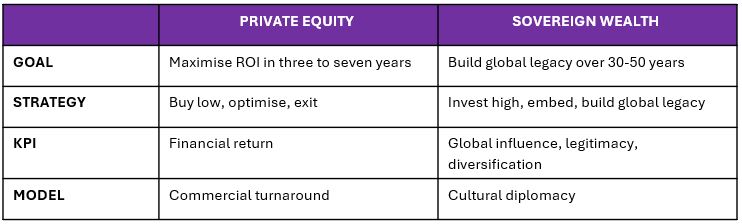

This is not just PE with a bigger chequebook

While private equity typically looks for returns within three to seven years, sovereign wealth funds are increasingly distinguished by their long-term investment horizon. Their approach to success goes beyond immediate financial gain, encompassing broader objectives such as international legitmacy, cultural leadership and legacy-building. By investing in infrastructure and fostering strategic global influence, these funds aim to shape not only economic outcomes but also cultural narratives and geopolitical positioning for generations to come.

Sovereign wealth brings permanence and permanence changes everything.

A cross-sport, cross-industry strategy

This isn’t just about football clubs. SWFs are shaping entire sporting ecosystems:

- Golf: LIV Golf shook up the PGA Tour and changed golf’s global power structure

- Motorsport: Saudi and UAE host flagship F1 races and invest in broadcast tech

- Esports: Saudi Arabia aims to become a top esports hub globally by 2030

- Combat Sports: UFC, WWE and major boxing events now central to the Gulf sports calendar

- Women’s Sport: Targeted growth in football and Olympic formats for image building

Sport is no longer a vertical. In this globalised investment play, it becomes a vehicle for transformation across identity, diplomacy and diversification.

The Risk Landscape

The growing influence of sovereign wealth in global sports is not without controversy:

- Sportswashing – Investments are seen as attempts to launder reputations and deflect attention from human rights concerns.

- Regulatory pressure – Regulatory bodies such as FIFA, UEFA, IOC and others face new challenges on transparency and ownership.

- Fan mistrust – Local communities may reject politicised or top-down control, fuelling mistrust.

- Brand dilution – The cultural integrity of beloved clubs is at risk of being reduced to extensions of state agendas rather than remaining authentic and community-rooted institutions.

A delicate balance is needed: operational excellence and cultural fluency.

How we can help

Sovereign wealth brings unmatched scale – but it requires more than capital to succeed. It demands commercial fluency, cultural sensitivity and a long-term operating model built on trust.

At Elixirr, we help businesses investors and operators turn ambition into impact:

- Strategic investment planning across leagues, clubs and sports

- Governance, brand architecture and local stakeholder alignment

- Post-acquisition integration for multi-club and cross-sport models

- Commercial performance acceleration and audience engagement

- Long-term strategy using sport as a vehicle for success

We help build operating models that match strategic ambition – without compromising identity. From football to F1 to esports, sovereign wealth funds are building the next great sports empires – not for resale, but for global reach. As ownership evolves, the key to success lies in the interplay between ambition and authenticity.

In our next and final piece, we move from nations to icons: the rise of celebrity ownership and the power of influence to reshape the sport-business-media equation.