Data drives the automotive industry, and risk intelligence is key to shaping car insurance pricing and claims. Yet, despite holding a vast and valuable database, Thatcham Research found its insights were not being fully leveraged by its members—who underwrite around 96% of motor premiums in the UK.

To bridge this gap, Thatcham Research has partnered with Elixirr to introduce the Value Optimiser—a bespoke service designed to unlock deeper analytics and help insurers stay competitive in an evolving market. Through tailored surveys, interactive workshops and advanced data insights, this initiative empowers insurers with the intelligence needed to navigate industry shifts.

Watch the video to see how the Value Optimiser can support your business:

Please note this is only available to insurers who are members of Thatcham Research. Thatcham Research is a not-for-profit automotive risk intelligence company dedicated to understanding the opportunities and risks of new vehicle technologies. To learn more about Thatcham’s membership, please click here. Or, read the full press release here.

If you’re a Thatcham Research member and want to learn more about this complimentary service and how it can help you maximise the value of Thatcham’s data, reach out to us below.

You may also like

Articles

Unlocking business value through data analytics: Real-world applications across industries

Articles

Data security and emerging technologies in the Charity sector

News

Peak Performance Project (P3) selects Elixirr to provide data & analytics capabilities to power its rapid growth initiatives

Articles

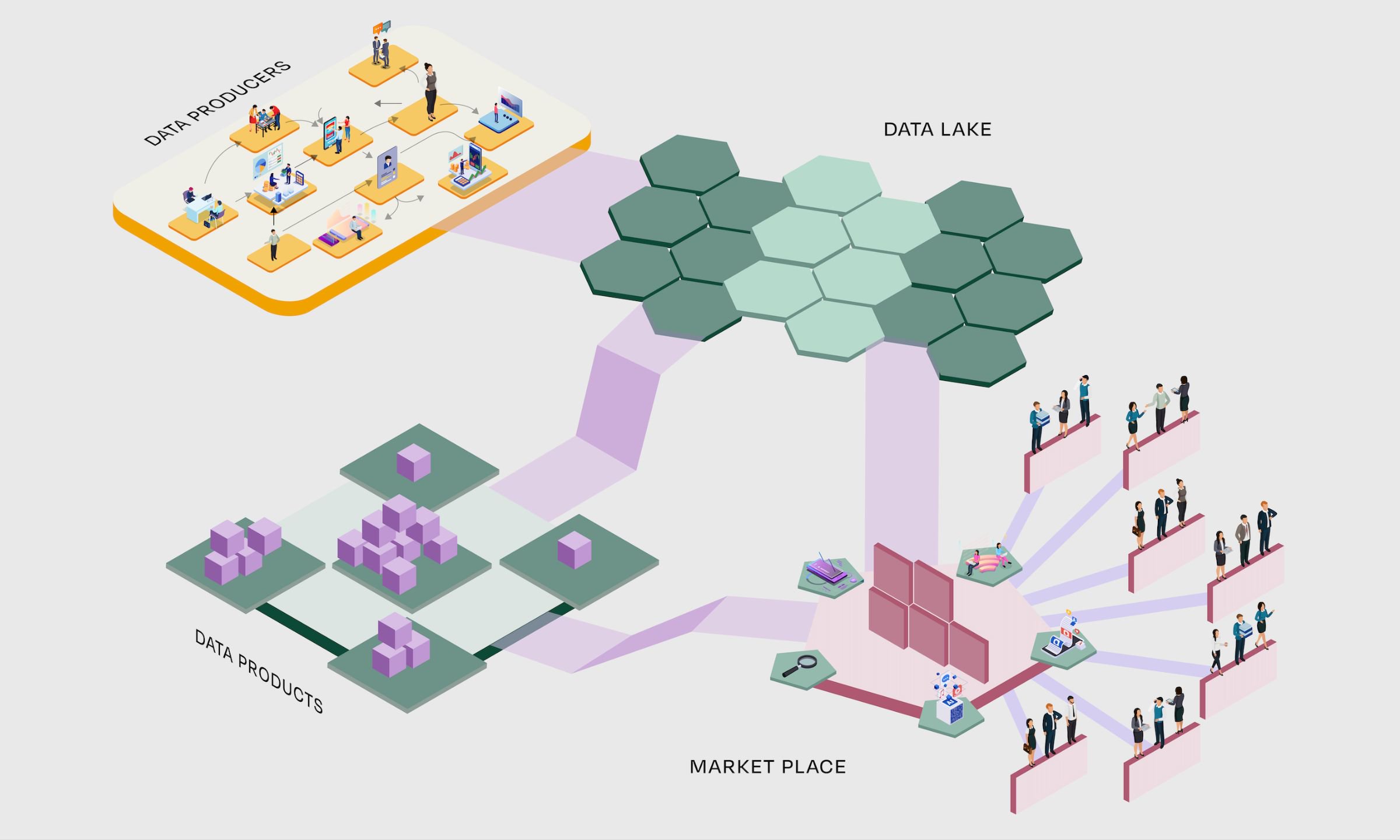

A productised banking data ecosystem leads to better data security, cost and scale

News

Elixirr partners with In516ht, an Elite Snowflake Partner, to expand its EMEA technical delivery support

Articles

History meets innovation: off-pitch legacy and on-pitch strategy in the URC

Articles

2024 Trends: Data

Articles

Your game plan for future-proofing sports data and analytics

Articles

Insurers: invest in data to drive growth

Articles