Articles

Banking on Data: Part II

In part one of this Banking on Data series, we argued that banks must establish a foundation for data-driven client centricity through the implementation of a well-managed data transformation journey.…

In part one of this Banking on Data series, we argued that banks must establish a foundation for data-driven client centricity through the implementation of a well-managed data transformation journey. We touched on the first two themes; namely, providing management with immediate benefits and addressing static client data issues.

In part two, we continue exploring the steps that banks must take as part of their transformation journey if they want to achieve a complete transition to client centricity.

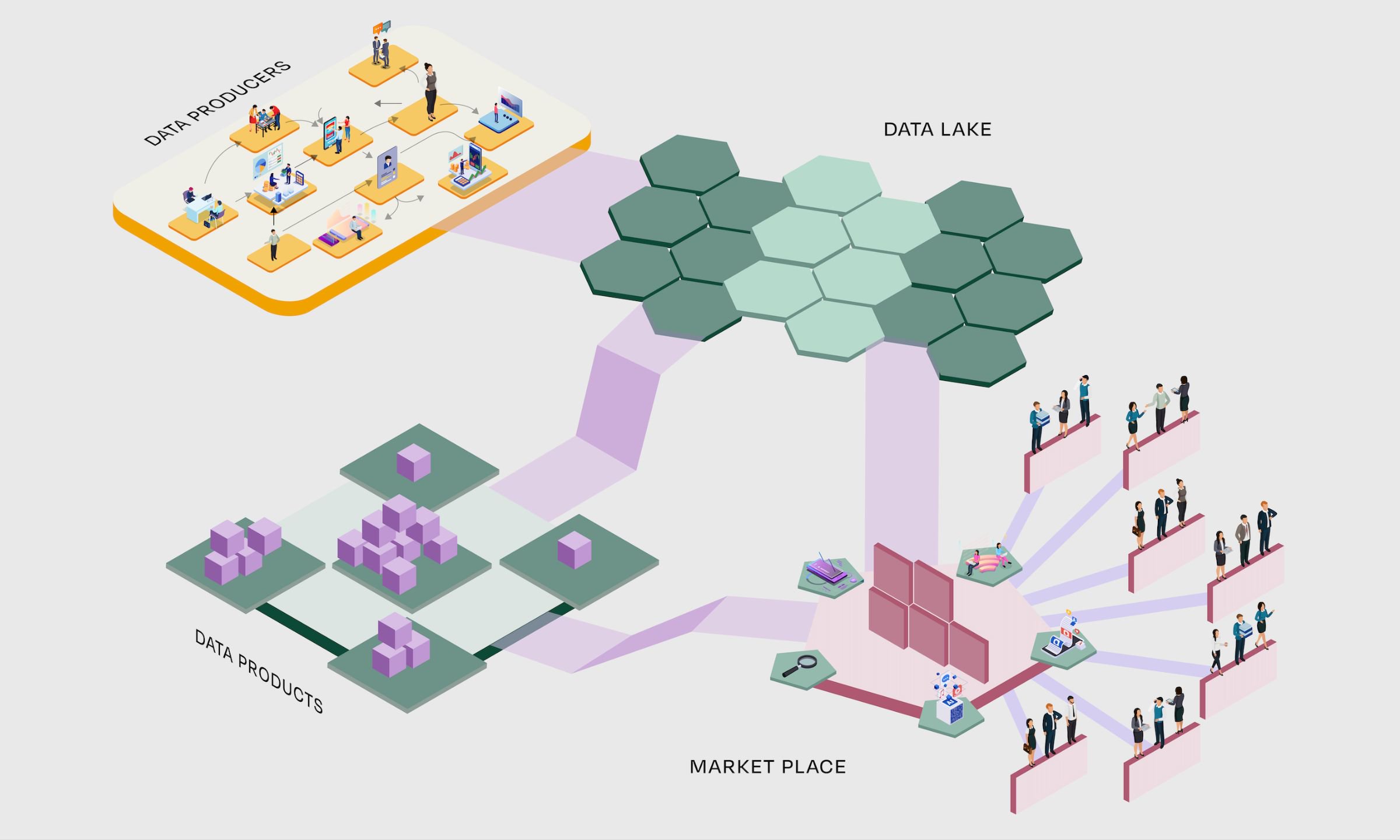

Embrace the fintech ecosystem and tap into existing capabilities

Lengthy in-house build timelines are a thing of the past. To harness the benefits of cleansed data and scale, organisations must take advantage of the ecosystem of entity resolution providers. Firms such as Quantexa and Ripjar will enable banks to no longer use ‘siloed business units’ as an excuse for not creating a single consolidated static client view. Moreover, it will stop them from having to undertake the arduous activity of moving data or building separate data platforms. These providers also have the ability to enrich internal data with trusted external sources to not only supplement internal data, but also make sure the bank’s client information is up to date. This is an added benefit in itself.

Creating an initial MVP through partnering with these fintech companies will quickly demonstrate the potential value to the organisation. Moreover, it will convert a ‘concept’ into a tangible asset that stakeholders can buy into. Although, to achieve this there must be comprehensive and thorough rules in place.

Don’t stop there, continue bitesize future investments

It is essential that future application-led investments are made within each business unit. These should be built on top of the static client data view, leveraging the same technology to eventually build a subsequent client “golden” record comprised of product holdings, transactions and so on.

Incrementally, this then starts to create significant business value within each business unit based on their specific needs. It also starts to slowly build a single picture across the bank which consolidates core client data in one place. Business units should then take the next stride to use this wealth of information, collected across the organisation, as a formidable asset to run analytics and predictive decision making. In turn, this sets off a domino effect, pivoting a historically transaction-focussed institution into one that truly knows their clients and can be on the front foot in catering to their evolving needs.

Break the status quo and become the leader in disruption

Becoming client centric requires more than just some high level strategy slides in an investor pack; it requires real action. Ultimately, the messaging on these slides – the usual spiel on what the organisation is doing to transform to data and customer centricity – is the same being communicated by every bank on the street. The only difference is their own branding.

Shareholders and clients are fed up of the wholesale banking industry constantly lagging behind other industries. They want to see tangible change based on their interactions with banks. Leaders within wholesale banks need to break the status quo of wanting to get to the end-state tomorrow. The crucial steps to becoming a leader in disruption are patience and a laser focus on the core objective of each journey step, without losing sight of the fundamental reason for the transformation – their clients. Moreover, the removal of “historic egos”, which have long driven banks to exclusively build in-house, is equally as vital.

Becoming client centric requires more than just some high level strategy slides in an investor pack; it requires real action.

The bottom line

Let’s face it, this isn’t the most glamorous of transformation programmes. However, it is one that is vital in order to build the solid data foundation that banks need to progress. These changes will allow wholesale banks to embrace digital disruption and become truly client centric, data-driven organisations. They will house the capabilities to offer clients a ‘one firm’ experience, no matter what part of the organisation they engage with, in addition to a single firm-wide client view. Doing so will unlock significant value now and in the future, from simplifying onboarding processing, holistic client risk analysis, unlocking of significant CRM (customer relationship management) and revenue growth opportunities.

Time is running out and all the excuses have been used. Wholesale banks need to be brave, trust the process and be a leader by breaking the mould. Imagine a world where we can finally say wholesale banking is the ‘gold standard’ industry when it comes to client centricity and personalisation……well don’t imagine. With the amount of data banks hold, the capabilities they house and the rapid pace of fintech innovation around them, there is no reason why this can’t be a reality.

Want to find out how this can apply to your organisation? Get in touch with our team today.