Articles

Why traditional nudges fail and how nudge 2.0 can fix them

Foreword

Across today’s services landscape, presented with a sea of choice, customer’s aren’t swimming – they’re sinking.

In a market obsessed with expanding product ranges, adding digital features and competing on customer experience, decision paralysis is silently killing growth and customers are disengaging at the moments that matter most.

This comes with a cost – customers miss opportunities to improve their financial wellbeing whilst institutions see this play out in lost conversions, diminished trust and weakened loyalty. Traditional nudge theory, historically relied upon to influence behavior – is no longer fit for purpose in today’s dynamic, emotionally charged, digital-first world.

Organizations must now think ahead – nudge 2.0 provides an adaptive influence loop, a live, learning system that replaces static nudges with real-time, emotionally tuned interventions that scale trust and action.

Introducing nudge theory

In today’s world, we find ourselves with more choices than ever before; should I invest more in my pension or focus on building an emergency fund? Should I choose a fixed-rate mortgage or a variable one? Is now the right time to invest in stocks, real estate, or perhaps cryptocurrency? How should I structure my insurance coverage? The challenge lies in the paradox that more choice doesn’t strictly mean better decisions. Recent research leads us to believe that the over-exposure to the excess of options can be overwhelming – when people feel overwhelmed, often, they do nothing at all.

That is exactly why the way we present choices does matter. Nudge theory, brought into prominence by Richard Thaler and Cass Sunstein in ‘Nudge: Improving Decisions About Health, Wealth, and Happiness,’ showed how changing the way choices are presented can improve decisions without removing freedom. This concept of ‘choice architecture’, has driven results from public policy to personal finance.

Examples are well known. The UK government’s ‘nudge unit’ increased tax payments by £30 million a year by adding a single line to reminder letters. HSBC used nudge theory in customer communications to save its customers £85 million in overdraft charges in just one month. Imperial College London, found that health-related nudges increased healthier eating by 15 percent.

Examples of traditional nudging are well established – from automatic pension enrollment to savings reminders and fraud alerts. However, whilst historically effective, the current and previous approach relies on static broad nudges at fixed moments in time. In a landscape shaped by real-time engagement, emotional nuance and elevated expectations – this approach is no longer good enough.

Why the old model falls short

The newest generation of wealth holders, Gen Z and younger millennials, represent the most diverse wealth strategies seen to date. Some are building property portfolios, others are growing pension pots, many are investing in instruments on established financial markets, and an increasing number are exploring digital assets such as crypto. Across the board, technology, speed and personal values still shape every decision, presenting a strong and robust argument for an evolution of the old model.

The scale of this behavioral shift is striking: three in four millennials would switch banks for a better mobile experience. The average Gen Z customer now checks their banking app 21 times a month. Nearly 40% want automated guidance on managing their money, and almost a third are ready for an AI assistant in their pocket. This is not occasional engagement, it’s an always-on relationship with money, and it signals a desire for tools and strategies that actively support wealth creation and preservation.

This leads us to challenge why the traditional nudges adopted by most services organizations are so heavily relied upon. Principally, the static nudging model is built on four flawed assumptions:

-

- Limited touchpoints: Engagement happens sporadically, despite the fact that mobile banking is a daily occurrence for most.

-

- Scheduled and blanket messaging: Broad, one-size-fits-all communications, scheduled at generic points, ignore local context and life stage; treating a first-time buyer in London, the same as an experienced investor in Manchester.

-

- Generic demographic profiling: Segments customers into generic demographic profiles e.g., 25–35-year-olds in London. This overlooks the influence of differing personality typologies, heuristics and biases in decision-making and ignores the unique and contextual needs of each individual.

-

- Measures success by clicks: This approach ignores the overall impact of the nudge and importantly, whether it contributed to customers financial resilience and wellbeing.

This presents an opportunity for a far more dynamic, personalized and effective approach – nudge 2.0.

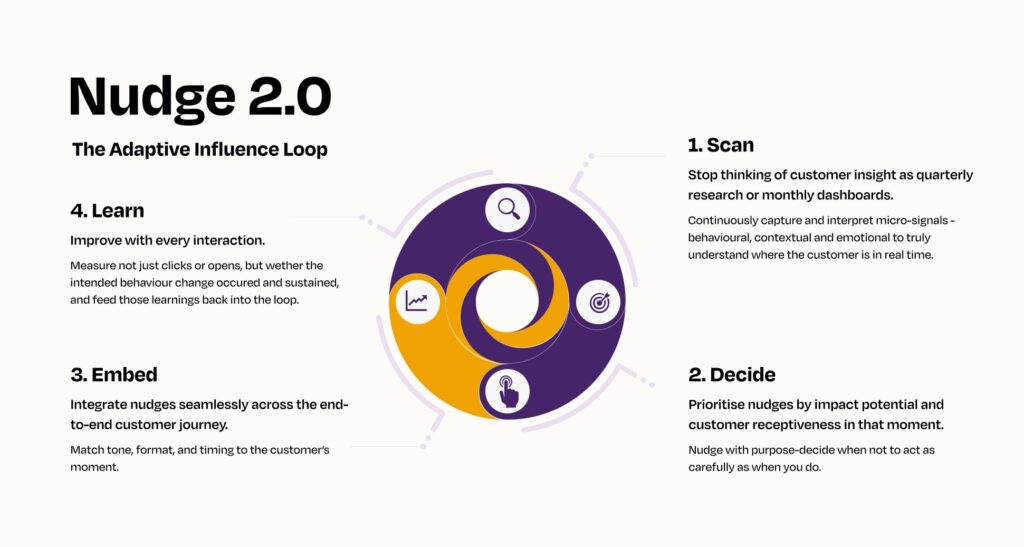

The Elixirr nudge 2.0 framework: The adaptive influence loop

Basic personalization presented in traditional nudge theory is rule-based and often reactive – it follows binary triggers, i.e., ‘customer clicked X, so show Y.’ While this can improve relevance, it remains limited to static segments, historic behaviors, or overly simplistic triggers.

Nudge 2.0, by contrast, is dynamic, context-aware, and continuously evolving based on real-time signals. It exists to increase the financial resilience and wellbeing of consumers. It works by blending behavioral science with AI to learn and adjust in the moment. The goal is not to nudge more often but to nudge smarter, in the moments that matter most.

Nudge 2.0 works as an adaptive influence loop. It continuously scans, decides, acts and learns. For example, a customer checking their balance at two o’clock in the morning may need reassurance or emergency support. At lunchtime, that same action might prompt a savings nudge or a personalized offer.

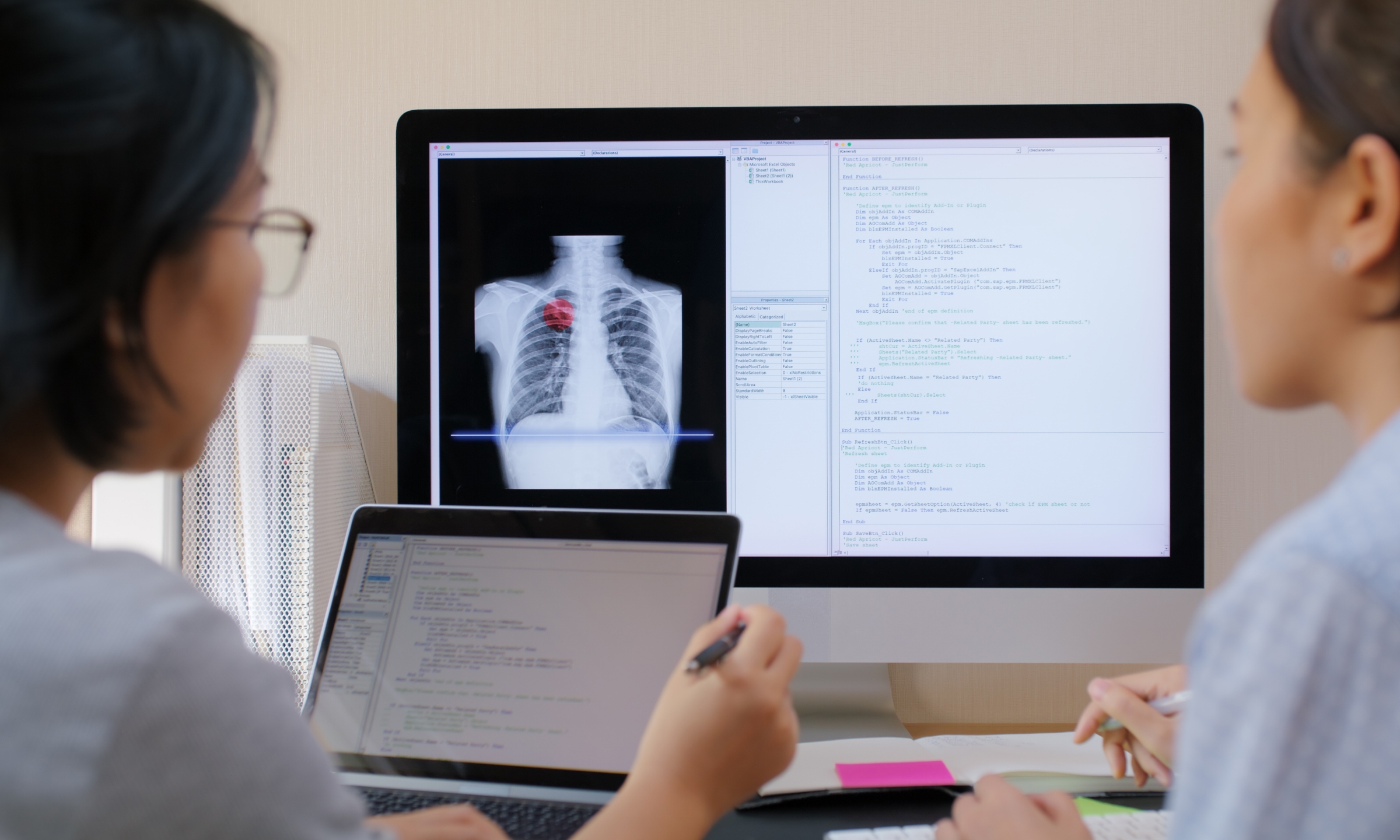

These examples demonstrate how nudge 2.0 works to build trust and drive beneficial outcomes for each customers unique context, while also highlighting the opportunity to change the traditional services-based model. The graphic below highlights the evolution of Elixirr’s nudge 2.0 theory vs the traditional concept:

Click the image to unlock the full experience

Nudge 2.0 – The evolution

Overview of nudge 2.0

Click the image to unlock the full experience

he nudge 2.0 adaptive influence loop is enabled by:

- Real-time data ingestion – Captures behavioral, contextual and situational signals from banking channels. At its most advanced, it also draws on wider non-FS behavioral data (e.g., holiday booking patterns, music preferences, or sports fandom), creating a truly multidimensional and nuanced understanding of each individual.

- Leveraging behavioral insight to better understand individual – Going beyond demographics to uncover what truly drives financial decisions, such as whether frequent balance checks are signs of worry or healthy money habits.

- Smart decision-making – Using AI to predict needs and recommend the right action at the right time, from encouraging savings to preventing overspending.

- Feedback-driven learning loops – Learning from every customer response to continuously test and improve messages over time so that each nudge becomes smarter, more timely and more relevant.

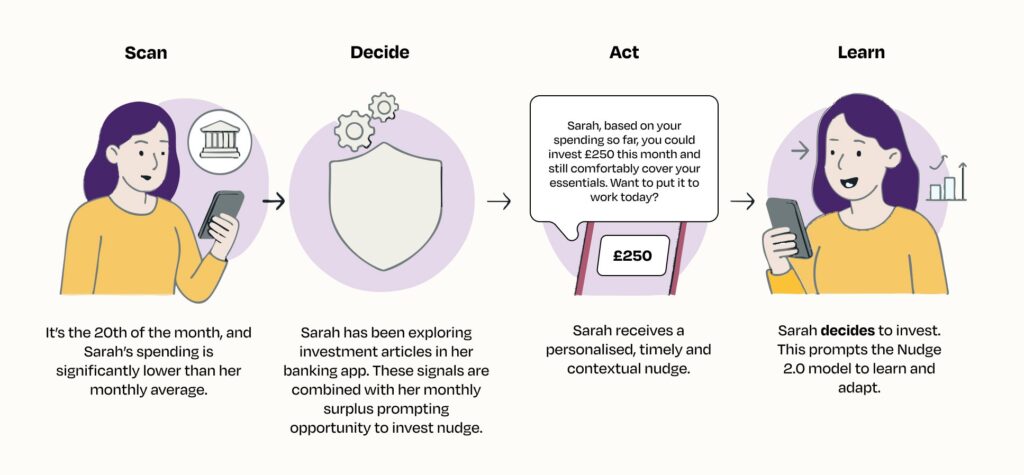

EXAMPLE 1

Nudge 2.0 in action – meet Sarah

Click the image to unlock the full experience

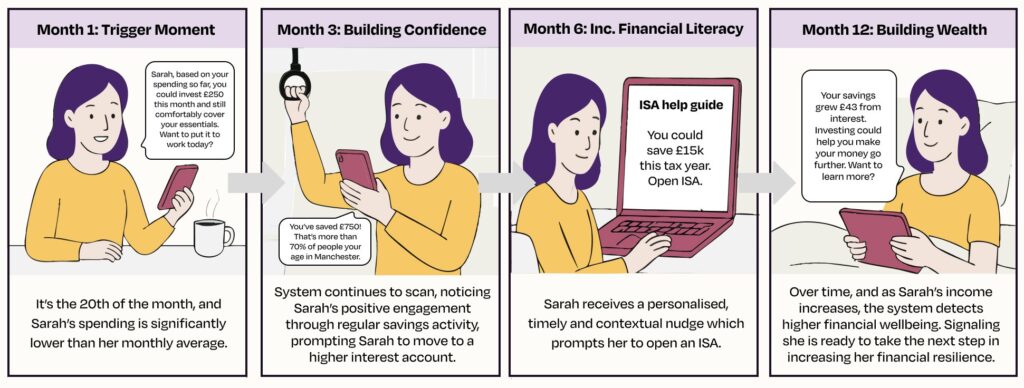

Meet Sarah – a young professional with aspirations to invest but no clear understanding of how and when to start. On the 20th of the month, her spending is tracking well below her norm. The nudge 2.0 framework scans these patterns in real time, integrating behavioral cues with contextual data, like her recent interest in investment accounts, her cash position, upcoming salary and increased use of discount codes, signalling an increased preference for saving.

These signals prompt a decision – there is a moment that matters. A single and precise prompt is sent. The timing intentional and the choice simple, allowing Sarah to act immediately.

In the background, the loop learns, capturing not just what Sarah did, but how and when she chose to do it. Future nudges will now be tuned to her decision-making style, ensuring each interaction builds on the last.

Sarah’s experience is just one example of how Nudge 2.0 turns everyday customer interactions into moments of real impact. By spotting the right opportunity, delivering the right message, and learning from each response, the framework transforms insight into action in a way that feels natural to the customer whilst also delivering measurable value to the organization.

EXAMPLE 2

Click the image to unlock the full experience

Meet Sarah – a young professional who wants to take control of her finances but does not know how and where to start. At the start of the year, the nudge 2.0 framework detects her recurring monthly surplus and offers a simple, well-timed suggestion to begin saving.

Over the following months, the system continues to scan her behavior in real time, integrating cues such as her frequent balance checks, in app searches about ISAs and growing interest in investment content. Each signal prompts a tailored decision point – a single, precise nudge delivered at just the right moment.

In the background, the loop learns, capturing not just what Sarah did, but how and when she chose to do it. Future nudges will now be tuned to her decision-making style, ensuring each interaction builds on the last.

By the end of the year, Sarah has moved from tentative saver to confident investor, steadily building resilience and wealth. Her experience illustrates how nudge 2.0 transforms everyday financial interactions into meaningful progress, aligning customer wellbeing with measurable organizational value.

The business case: Beyond engagement

For financial institutions, nudge 2.0 isn’t just about improving click‑through rates or app usage. It’s a strategic enabler of compliance, trust, and measurable customer outcomes.

- Revenue uplift: Higher conversions and retention through relevant, well-timed action prompts.

- Regulatory shield: Time-stamped, auditable nudges prove relevance, timeliness, and alignment with the customer’s best interests under Consumer Duty.

- Protection of vulnerable customers: Using real-time behavioral cues to identify distress, urgency, or disengagement.

- Behavioral science and consumer duty: Incorporating real time behavioral data to identify signs of vulnerability and enable timely, tailored interventions that guide individuals through complex choices. By mitigating common biases and providing auditable evidence of fairness and relevance, behavioral insights ensure targeted support is both effective and compliant.

- Fair value assurance: Ensuring customers are nudged toward appropriate products and avoiding poor outcomes.

- Brand differentiation: Making customers feel understood, supported and guided.

Insights for financial services leaders

To translate behavioral insight and AI potential into measurable customer, compliance and commercial outcomes, financial services leaders must:

- Bring together the latest innovations in behavioral science and AI: Design nudges grounded in psychology and powered by live data.

- Map the micro‑moments: Identify the exact points in the journey where small prompts make the biggest impact.

- Build nudges into the flow: Integrate nudges naturally into digital experiences, such that they integrate seamlessly.

- Close the loop: Measure outcomes, learn fast and continuously refine.

Competing on products and rates alone is a race to the bottom. The next wave of advantage will go to those institutions that can move beyond transactions to deliver guidance and support in the moments that customers need it most.

Nudge 2.0 is not about giving people more to choose from. It is about making it easier for them to make choices that improve their lives and strengthen their financial wellbeing. When customers feel supported and confident in their decisions, they stay. Helping people make better decisions is not just good business, it deepens your understandings of you customer base, enabling proactive understanding and creating lasting value for them and in turn, lasting advantage for you.