Articles

Harnessing AI in private market investing

In the second episode of The Enterprise AI Playbook: How Leaders Drive AI Transformation, Adam Hofmann, Generative AI Practice Lead, speaks with Scott Kraemer, Head of Markets in the US from…

In the second episode of The Enterprise AI Playbook: How Leaders Drive AI Transformation, Adam Hofmann, Generative AI Practice Lead, speaks with Scott Kraemer, Head of Markets in the US from the Aztec Group – a leading provider of fund, corporate, and investor services.

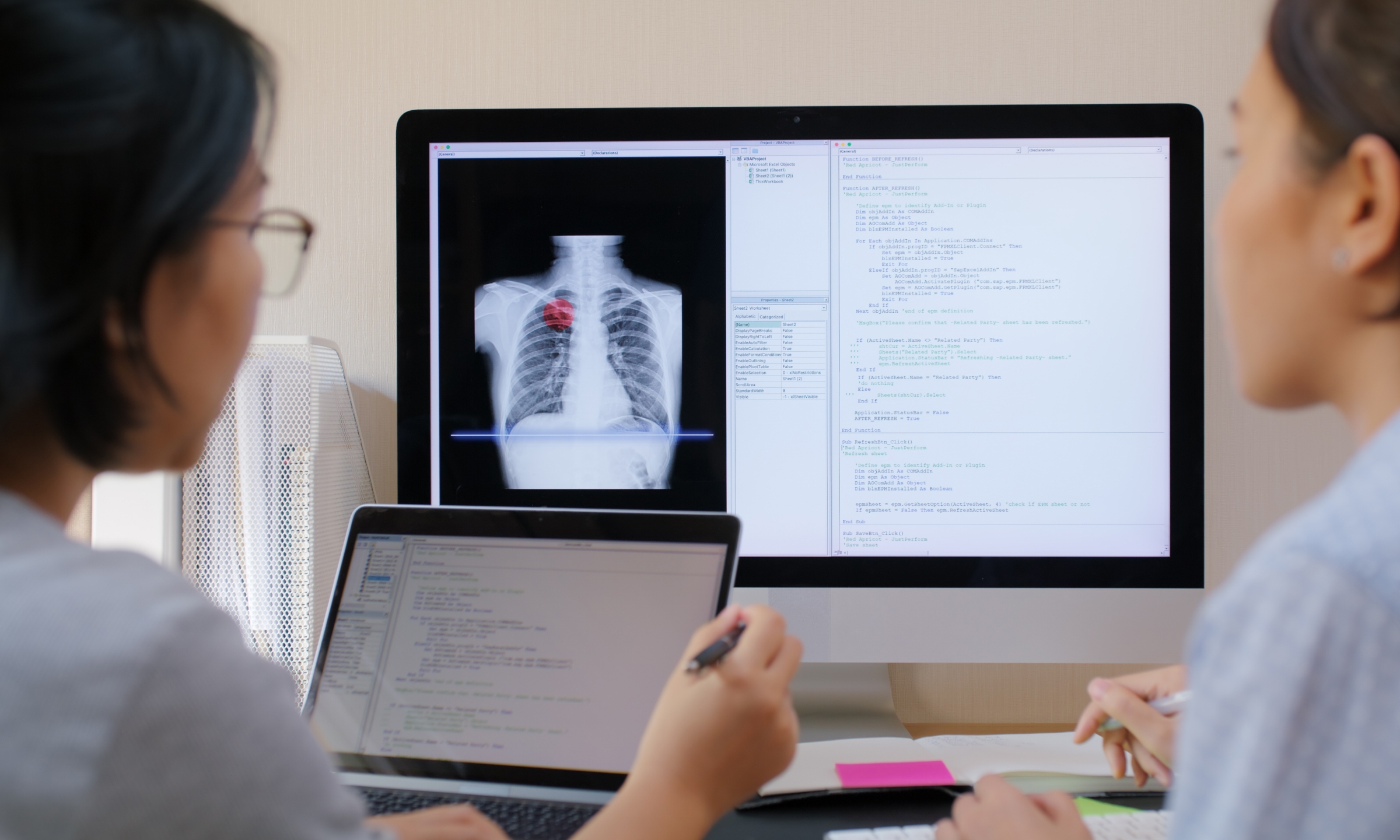

In this insightful conversation, they discuss the evolving landscape of private market investing, with a particular focus on the transformative role of technology and AI. The discussion dives deep into how AI is reshaping the way investment firms operate – from fund administration to investor engagement – while also addressing the operational challenges that come with digital transformation.

Fund administration: AI is reshaping both strategy and operations

Scott also breaks down the dual focus of AI within the fund administration industry, highlighting two key areas where it’s making a transformative impact. First, AI plays a critical role in helping investment managers make more informed decisions about where to allocate capital. By analysing large volumes of market data, trends, and historical performance, AI supports faster and more strategic deal sourcing.

The second area of focus lies in the operational side of fund management: how firms process, track, and report on investments. These two applications: investment strategy and operational optimization reflect the broader dual impact of AI on the private markets ecosystem.

The rise of the retail investor

One of the more exciting points raised is the democratisation of private market access. As platforms and AI-driven tools become more sophisticated, there is strong potential for retail investors to gain greater access to private assets – traditionally a space reserved for institutional players. This opens new opportunities for market participation and portfolio diversification on a broader scale.

Throughout the conversation, Scott also shares personal anecdotes about using AI in everyday tasks, illustrating how these technologies are becoming seamlessly embedded in both professional and personal routines. Ultimately, the episode underscores a clear message: the future of private market investing belongs to firms that can strategically harness AI, manage change effectively, and maintain a sharp focus on data excellence in a rapidly evolving digital environment.