Articles

Top 5 disruptive forces and critical success factors for the medtech industry

With annual healthcare spending in the U.S. alone projected to hit $6.8 trillion by 2030, medtech companies have a unique opportunity to seize a share of the $300 billion to…

With annual healthcare spending in the U.S. alone projected to hit $6.8 trillion by 2030, medtech companies have a unique opportunity to seize a share of the $300 billion to $400 billion expected to be spent on medical devices. However, navigating this fast-evolving landscape requires more than incremental innovations; it demands a complete rethinking of strategies and capabilities.

Based on industry research and insights from global executives across the medtech industry, the top five disruptive forces are:

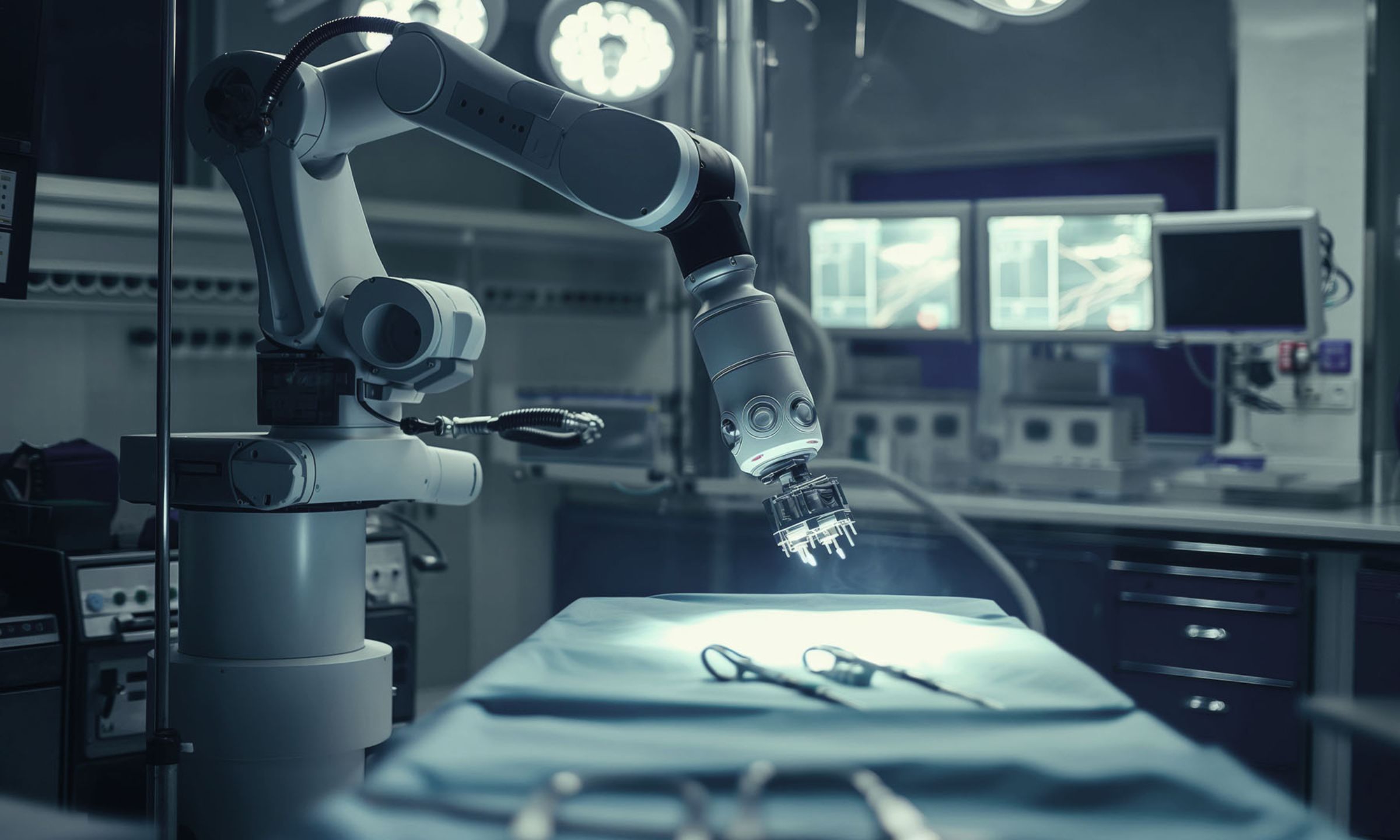

1. An AI-powered digital health revolution

AI-enabled devices are transforming diagnostics, treatment personalization and patient monitoring by leveraging real-time data analytics. In 2023 alone, AI-driven technologies hit record numbers of FDA approvals, showcasing the rapid acceleration of this trend. Beyond diagnostics, AI’s ability to integrate vast amounts of patient data from wearable devices, electronic health records and other sources is empowering providers to offer more targeted care. However, as this transformation unfolds, medtech companies face significant challenges. Navigating the evolving regulatory landscape is crucial, especially as many AI applications fall outside traditional approval frameworks. Data privacy and security concerns also loom large, as companies must safeguard sensitive patient information while adopting AI-driven solutions.

2. Consumers are in the driver’s seat

Patients increasingly demand “anywhere, everywhere” care, moving healthcare delivery away from hospitals and into homes, ambulatory care settings and virtual platforms. At the heart of this disruption is the rise of digital therapeutics and remote monitoring technologies. Devices that track vital signs, manage chronic conditions, or provide personalized feedback in real-time are now essential tools, enabling patients to take control of their health from anywhere. For medtech companies, success will hinge on creating seamless, intuitive experiences that integrate into patients’ daily lives. This consumer-driven shift also forces medtech firms to adopt new business models that prioritize long-term patient engagement over episodic care.

3. The regulatory frontier is expanding

Emerging regulatory pathways are becoming one of the most critical disruptors in the medtech industry. Historically, regulatory approval processes were built around hardware-based medical devices, but with the rise of AI and data-driven technologies, those frameworks are increasingly outdated. The challenge is exacerbated by the fact that AI technologies continuously learn and evolve, which conflicts with static approval systems designed for non-dynamic devices. Companies must now navigate new pathways to ensure compliance while ensuring their AI algorithms and digital health products remain flexible and effective. Regulatory bodies are working to address these gaps, but the evolving nature of regulations means medtech companies will need to be agile, investing heavily in compliance teams that can stay ahead of shifting rules.

4. Converging sectors and partnerships

As the lines between medtech, healthcare and consumer technology blur, medtech companies must adapt by forging strategic partnerships to remain competitive. This convergence demands that medtech companies incorporate software, data analytics and connectivity into their products. Partnerships with tech companies are crucial for accessing the expertise in AI, machine learning and user-friendly software. These collaborations enable firms to innovate faster, deliver more comprehensive solutions and meet the rising demand for consumer-centric healthcare. However, these partnerships come with challenges. Medtech companies must navigate data security, regulatory compliance and protect their intellectual property while sharing resources with tech partners.

5. Turbulent supply chains and inflation

Global supply chains, still reeling from pandemic-driven shocks, continue to experience bottlenecks and rising costs, while inflation exacerbates the problem by driving up the price of raw materials, labor and transportation. For medtech manufacturers, this poses a two-fold challenge: maintaining the affordability of their products while ensuring consistent delivery in an increasingly volatile supply chain environment. Executives will need to rethink their supply chain strategies to build resilience. This might involve relocalising production, diversifying suppliers and deepening partnerships with logistics providers. Navigating this landscape will require agility, as only companies that can adapt to the evolving dynamics of inflation and supply chain disruptions will maintain competitive advantage and profitability in the long term.

For medtech executives and enterprises to survive—and thrive—over the next five years, capitalizing on the following critical success factors will be key:

A strong core is key to longevity

This requires a comprehensive evaluation of existing capabilities, from AI-driven technologies to digital health offerings. By understanding where their products and expertise already excel, companies can focus on amplifying these strengths as part of their differentiation strategy, ensuring they stand out in a crowded market. Next, companies should embrace AI innovations and digital therapeutics as foundational elements. These technologies are rapidly transforming healthcare, providing more accurate diagnostics and personalized care. By investing in cutting-edge software development, machine learning and data analytics, medtech firms can enhance their offerings and stay ahead of competitors.

Think big and expand offerings

Companies that broaden their product and service portfolios will unlock new growth opportunities, adapt to consumer demands and differentiate from competitors. Companies must invest in market research and data analytics to identify gaps in the healthcare market. Whether it’s remote monitoring, AI-driven diagnostics, or digital therapeutics, understanding consumer pain points and provider needs will reveal areas ripe for expansion. Next, medtech firms should focus on developing complementary products and services. This may involve expanding beyond traditional medical devices into connected health ecosystems, creating a seamless integration of hardware, software and digital platforms. By offering holistic solutions, companies can build stronger relationships with patients and providers.

Set your sights on new markets

As traditional markets become saturated and competition intensifies, expanding into new geographic regions, therapeutic areas, or consumer segments offers fresh growth avenues. First, conduct a thorough market analysis. Evaluate global healthcare trends, regulatory environments and unmet needs in different regions. Emerging markets, particularly in Asia, Latin America and Africa, present significant opportunities for growth due to expanding healthcare infrastructure and rising demand for affordable medical technologies. Tailor the offerings to fit local demands and regulatory frameworks. Next, adapt and localize product portfolios for new markets. This means not only complying with local regulations but also customizing products to address specific regional health challenges. For example, low-cost, high-impact devices could thrive in developing regions, where healthcare budgets are constrained.

Melding hardware and software

Bringing hardware and software together into digital health ecosystems will be a crucial driver for medtech companies. As medical devices become smarter, combining them with software to create connected ecosystems will allow companies to capture and leverage data, improve patient outcomes and gain a competitive edge in the growing $140 billion digital health market. The first step is for companies to integrate hardware with software platforms that aggregate and analyse data from connected devices. Next, medtech firms must invest in interoperability. Ensuring that devices can communicate seamlessly with electronic health records (EHRs) and other healthcare IT systems is essential for creating a fully functioning ecosystem. This integration allows for smoother workflows and real-time data sharing between patients, providers and healthcare systems.

Reinvent your commercial model

Traditional commercial approaches are becoming outdated, rethink customer engagement by adopting customer-centric approaches, which require medtech companies to deeply understand their customers’ evolving needs and preferences. Tools like digital engagement platforms and AI-driven insights can help companies offer personalized, value-driven solutions. Companies should also focus on streamlining operations and increasing efficiency by leveraging digital tools and automation. This reduces reliance on traditional sales approaches and allows sales teams to engage more strategically with customers. Finally, medtech executives must ensure that leadership teams are incentivised to prioritize customer engagement, adopt new technologies and lead transformation across the organization.

The next five years are crucial

As medtech companies prepare to face the next five years of disruption and transformation, the path forward is clear: adaptability and innovation are non-negotiable. Navigating the AI-powered digital health revolution, addressing the rising demands of consumer-centric healthcare and mastering the expanding regulatory landscape will be crucial. Medtech leaders must also embrace strategic partnerships as sector convergence accelerates and they must develop supply chain strategies that withstand the pressures of inflation and global disruption.

However, disruption also presents incredible opportunity. Companies that leverage their core strengths, expand into new markets and evolve their commercial models to be more customer-focused will unlock not only financial growth but industry leadership. By embracing digital health ecosystems and forming partnerships across sectors, medtech companies can deliver more comprehensive care solutions and enhance patient outcomes. The question isn’t if medtech will evolve—it’s how prepared companies are to thrive in this environment. Are you ready to reinvent, adapt and lead in the medtech revolution?