Articles

Traditional revenue: Can we make the past work for the future?

Continuing our series We started by exploring the growing opportunity of sport as an asset class and all the ways it’s penetrating the market. We now want to take a…

Continuing our series

We started by exploring the growing opportunity of sport as an asset class and all the ways it’s penetrating the market. We now want to take a step back into the fundamentals of sport – the traditional revenue levers that underpin any business. In a new landscape of growing investment and new, exciting opportunities, organisations are at risk of neglecting its fundamentals – to the detriment of itself and its pursuit of these new opportunities. Organisations must prioritise the strength of its foundations to provide the bouncing board for growth.

This four-part mini-series will explore the four historic priority revenue generators in sport, how they have changed and how organisations should approach them to stay relevant in the new world.

The business of the game: Reimagining traditional revenue in modern sport

The business of sport is being radically reshaped. While ownership structures, private capital, and geopolitical strategies dominate headlines, the bedrock of the industry – its traditional revenue streams – is undergoing its own transformation. Media rights, matchday income, merchandise and sponsorship were once seen as stable, even staid. Today, they are the new frontier of innovation.

This series reframes traditional revenue not as a legacy concept, but as a dynamic arena where ambition meets opportunity.

Where the money still matters

In 2023, global media rights in sport generated over $56 billion. Stadium attendance roared back post-COVID. Sponsors realigned around purpose and data. Merch moved beyond replica kits into drops, collabs and digital goods.

And yet – the rules of the game have changed.

In today’s fragmented attention economy, value isn’t static. It’s earned. Traditional revenue streams must now compete across platforms, generations and geographies. What was once dependable has become dynamic – and those who understand this shift will lead the next decade of growth.

What this series explores

In this five-part series, we explore how each of the core revenue pillars is evolving, and how sports organisations can reimagine – not just optimise – them.

Part 1: Media rights: A market in flux. Fragmentation, format innovation and the fight for attention.

Part 2: Match Week: The stadium as stage. Monetising not just the seat, but the entire experience.

Part 3: Merchandise: Beyond the badge. How sportswear is becoming lifestyle, IP and collector culture.

Part 4: Sponsorship: From passive placement to strategic partnership. Data, purpose and fan alignment.

Final word:

Traditional revenue is no longer ‘business as usual.’ It’s business reimagined.

It’s where brand, culture and community intersect with commercial strategy. It’s where legacy meets reinvention and it’s where the next great play in sport will come from – not just for clubs and leagues, but for investors, rights-holders and fans alike.

We’re proud to be leading the conversation on how sport can evolve – not just with capital, but with clarity, creativity and commercial rigour.

The playbook is changing. We’re helping write it.

Our approach: We make sports organisations great businesses

At Elixirr, we bring the same commercial, operational and strategic excellence we’ve delivered across technology, financial services, consumer markets and the public sector – and apply it to sport.

We simply treat sports organisations as what they are: businesses.

Finally, the investment world is starting to agree. This shift is accelerating, demonstrated as private equity deals in sport nearly doubled between 2023 and 2024 alone.

Private equity, sovereign wealth funds, venture capital and even celebrities are now approaching sport not as a side bet, but as a core portfolio play – and the same expectations for performance, governance and growth now apply.

Sport is our new frontier – and we’re bringing a proven playbook.

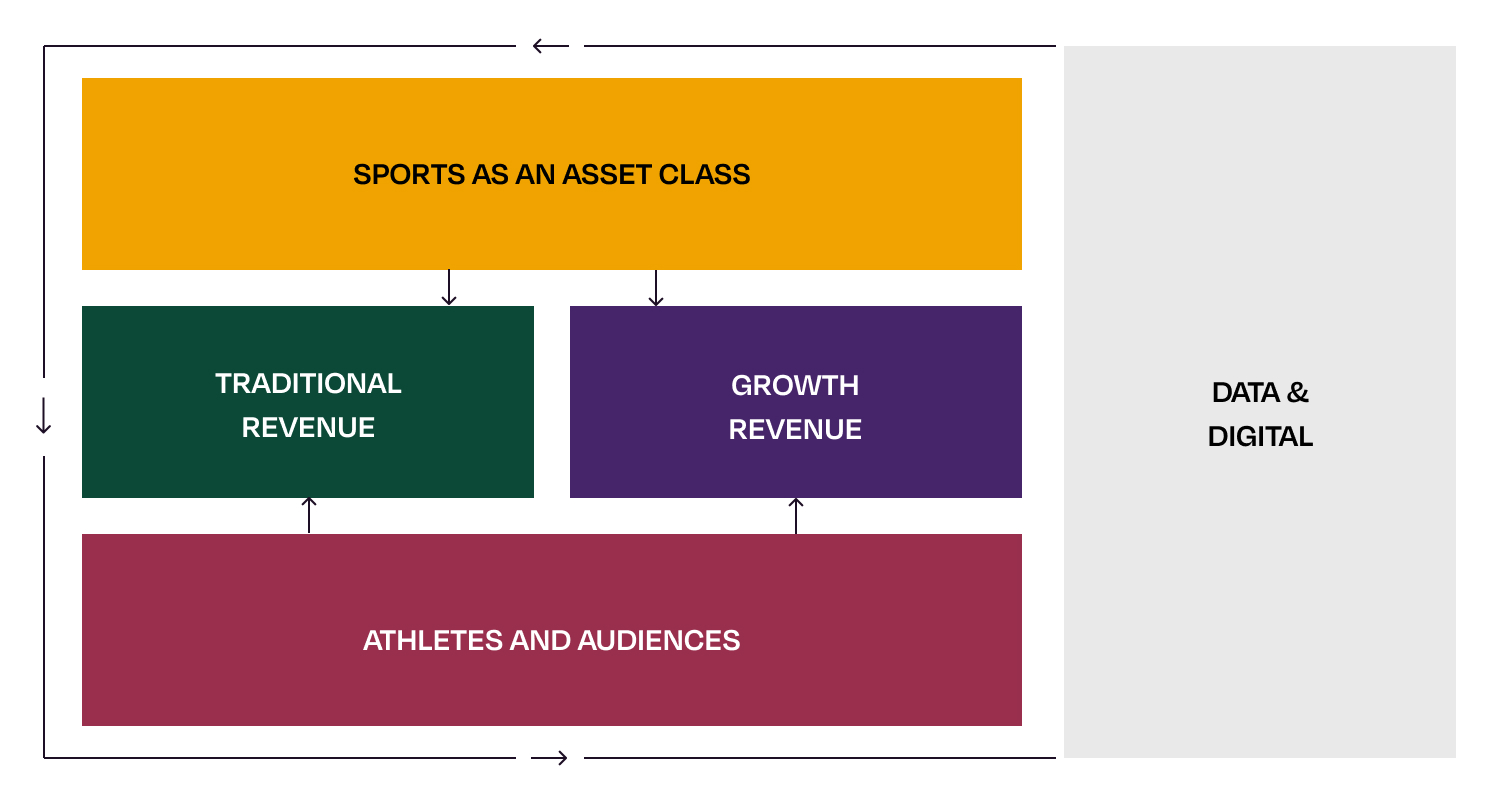

Introducing the Elixirr ‘modern sporting landscape’ framework

Our perspective

Sport is becoming one of the most investable, scalable and emotionally resonant industries in the world – but only for those who treat it with both commercial clarity and cultural sensitivity.

At Elixirr, we’re working with clubs, leagues, investors, and media platforms to do exactly that – delivering strategy, governance, brand, digital and operational enablement at every level.

Because sport doesn’t just need new owners.

It needs new playbooks.

Stay connected

Keep an eye out as we release each article in the series over the coming weeks.

If you’re investing in, operating, or advising in sport – and want to build a model that scales with purpose – get in touch here.

We’ve helped organisations become great businesses across every sector.

Sport is no different. Now, we’re bringing that success to the world’s most exciting industry.

A reminder: Our modern sporting matrix

We’ve launched a dedicated sports offering, built around our view of the modern sporting landscape – and what it will take to win in the years ahead.

1. Sport as an asset class

The evolution of ownership – from passion to portfolio. From private equity and sovereign wealth to venture capital and multi-club structures, ownership models are becoming more sophisticated, global and strategic.

2. Traditional revenue

The staples of sport – sponsorship, broadcast, ticketing and merchandising – still matter. But the model needs modernisation, innovation and commercial rigour to keep pace with rising valuations and shifting consumer habits.

3. Growth revenue

Fan engagement is moving from stadiums to screens. Revenue is growing through digital content, direct-to-fan experiences, and media rights (which topped $10bn globally in 2024) driving revenue growth and global relevance – and that’s without the mention of e-sports, new leagues, formats and geographies.

4. Athletes and audiences

The centre of gravity is shifting. Athletes are brands. Fans are stakeholders. And storytelling, player empowerment and second-screen experiences are creating deeper relationships and more dynamic ecosystems.

5. Data & digital

From instinct to insight: with global sports tech investment expected to reach $33 billion by 2028, the shift toward data, immersive technology and digital-first models is accelerating fast. The future of sport will be built on intelligence – across performance, content and commercial strategy.