Articles

How new formats and markets are rewriting the rules of sport

Let’s be honest: not every league has kept pace with how modern fans consume content, spend their time, or choose their communities – and we’ve moved beyond the idea that sport needs to be preserved in its legacy form.

The next wave of growth is coming from new formats and newly activated geographies – sports and leagues that are built for digital shareability, faster monetisation and cross-border engagement from day one. But ‘new’ is not code for ‘success’: new sports, formats and even teams must be strategic and thoughtful in order to engage a new audience or, risk immediately losing their novelty badge.

In this part of the series, we explore how new formats and markets are reshaping the revenue playbook – and why sport’s next big thing probably won’t look anything like the last.

The revaluation is already happening

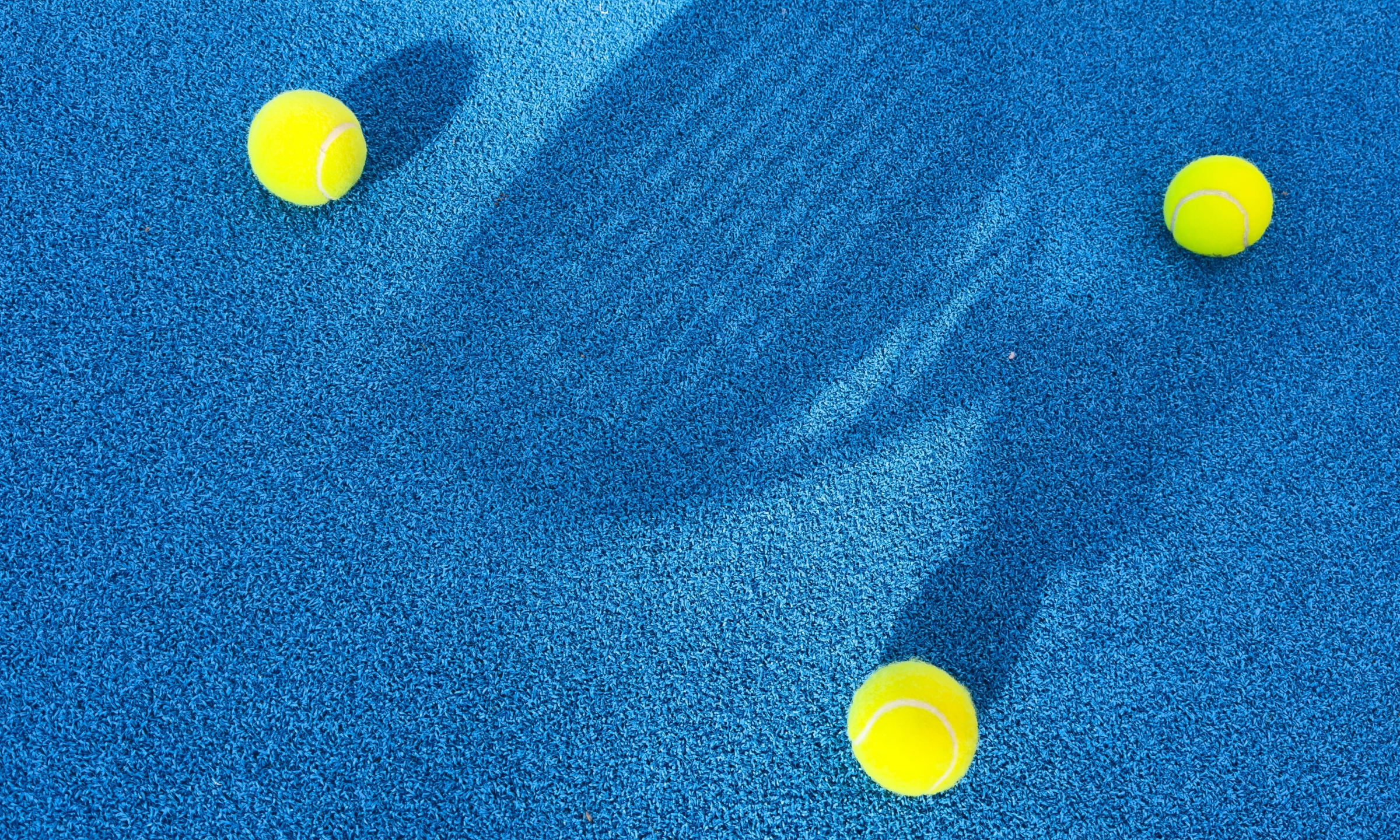

The numbers speak for themselves. Padel has exploded to more than 30 million global players, with 50,000+ courts worldwide and counting. The global padel market hit €2 billion in 2023 and is forecast to more than triple by 2026. Similarly, pickleball in the US surged to 13.6 million players, with backing from celebrities, brands and private equity.

At the same time, format innovation is hitting the mainstream. The Hundred condensed cricket into a 100-ball format, making it faster, more accessible and sponsor-friendly. LIV Golf also recently introduced 54-hole tournaments and team formats – backed by sovereign wealth capital and a full media machine. While, Pro Kabaddi League turned a regional game into a national franchise, drawing over 222 million viewers in India alone. This is sport reengineered and it’s scaling.

More than a format change – it’s a commercial strategy

There is a reason, beyond novelty, as to why these changes are landing. These formats are:

- Simple and scalable – making them easier to adopt across new markets and fan segments.

- Built for streaming and social – with shorter runtimes, viral moments and content modularity

- Cheaper to play and operate – especially relevant in emerging markets or urban areas

- Open to private capital – with fewer legacy constraints and more flexibility in ownership, branding and fan engagement models

This movement is about expanding what sport can be: and who gets to play, watch, or invest in it.

Where culture and capital are moving

What’s interesting is how these formats blend cultural traction with commercial momentum. Take padel, for example. The sport has been backed by the likes of Andy Murray, Zlatan Ibrahimović and Paquito Navarro. Additionally, it has seen rapid uptake in Spain, Sweden, the Middle East and India. It has also been professionalised through leagues like Premier Padel, backed by Qatar Sports Investments, with sponsors including NTT Data and Qatar Airways

Or look at Kabaddi, once a regional Indian sport, it’s now broadcast on Star Sports, with sponsorship from Tata Motors and franchises across major cities. It combines low-cost infrastructure with mass appeal and fast-paced, TV-ready action. These aren’t fringe sports anymore – they’re high-growth platforms, culturally resonant, digitally native and commercially viable.

Who’s getting it right?

Some examples worth spotlighting:

- Premier Padel – operating in 18 countries, with elite talent, global events and a long-term commercial roadmap

- The Hundred – delivering match attendance up 16% year-on-year, drawing 500k+ fans in its debut season

- LIV Golf – polarising but commercially aggressive, introducing team dynamics, shorter formats and content control

These leagues understand that the product isn’t just the game – it’s the format, the IP, the experience and the brand.

What still needs solving

As these formats mature, they’re now hitting scale challenges. Broadcast packaging remains a hurdle, as many formats still lack the rights infrastructure necessary to command top-tier fees. At the same time, global governance is often fragmented – competing federations and inconsistent rules can undermine credibility and limit the potential for Olympic recognition. Beyond governance, the depth of infrastructure also lags behind: in many regions, facilities, coaching systems and youth pathways have not yet caught up with the growing enthusiasm of fans or the expectations of investors – or there is simply not the space in the cities where the fandom is peaking.

There is also the challenge of an enthusiastic but limited market – teams and leagues are growing exponentially but the population stays (relatively) stable. Yes, you can engage a previously unengaged market, or turn heads of the fans from other sports, but this must be deliberate and planned. New sports and formats aren’t the means to an end – they must be strategically planned and carefully thought out to gain the market traction required.

These gaps aren’t insurmountable. But solving them will require operational clarity, long-term thinking and cross-border coordination.

The bigger play: Growth revenue in context

New formats alone don’t drive growth.

But targeted formats that merge market insights with a clear-as-ice strategy open the door to a huge growth opportunity in a market more malleable than ever.

These are not stand-alone experiments; they form a core part of the growth revenue quadrant, alongside women’s sport, digital fan engagement and esports. Together, these levers are redefining how value is created in sport.

Elixirr’s perspective

We’ve helped businesses across sectors do exactly what these leagues are trying to do – turn high-potential formats into high-growth platforms. Whether it’s launching products into new markets – from fintech to luxury – by finding the right customer, partner and model, or building scalable ecosystems where infrastructure, content and community reinforce one another, the playbook is the same. We’ve also created commercial models around underdeveloped assets, always with a focus on speed, simplicity and unlocking value.